Gold is heavy. In the old days, those people who preferred not to carry around their material wealth opted to leave it for safekeeping with the first bankers. In return for their gold, depositers were given a bank note that promised to reimburse the bearer with the amount of gold stated on the note. Over time people became accustomed to trading with these promissory notes to the extent that the gold itself was seldom demanded. Recognising this, the bankers cheated the system by producing more notes than they had gold deposits, in order to make loans. By charging interest on these loans they could acquire more gold, thereby accruing wealth from paper of no value.

If, as a result, people lost confidence in the bank they could return to claim their gold, creating a run on the bank. People redeeming their notes could empty the bank of gold leaving unlucky customers with notes that had no backing and therefore no value.

Banks mitigated this risk of bankruptcy by operating with no more than ten times more notes than they had deposits of gold. This banking practice of holding only a fraction of the reserves necessary to back the notes in circulation, is called fractional reserve banking.

Many items can be used as money. The value of money is only that which traders agree upon. Chroniclers of the early European expeditions to the Americas found that where the explorers lusted after gold, the indigenous population often valued feathers and beads more highly. Bartolome de las Casas observed:

"They prize bird feathers of various colors, beads made of fishbones, and green and white stones with which they adorn their ears and lips, but they put no value on gold and other precious things. They lack all manner of commerce, neither buying nor selling, and rely exclusively on their natural environment for maintenance. They are extremely generous with their possessions and by the same token covet the possessions of their friends and expect the same degree of liberality."

Precious metals served Europeans as money. These were assessed and increments of coinage were given a stamp of certification by the issuer to guarantee a certain weight and level of purity or value.

Gold was used to back currency not only because of its physical properties, but also because the amount of gold in the world does not vary significantly. If it was suddenly to become plentiful its value would decrease.

G.Edward Griffin writes that,

"the stability of gold as a measure of value is…striking. At the Savoy Hotel in London, one gold sovereign will still buy dinner for three, exactly as it did in 1913. And, in ancient Rome, the cost of a finely made toga, belt, and pair of sandals was one ounce of gold. That is almost exactly the same cost today, two-thousand years later, for a hand-crafted suit, belt, and a pair of dress shoes. There are no central banks or other human institutions which could even come close to providing that kind of price stability. And, yet, it is totally automatic under a gold standard."

Silver is similarly stable and was chosen as the basis of the American dollar because, being more plentiful than gold, it was more difficult for investors to monopolise.

When money is not backed by gold or silver and is given its value by government decree or 'fiat' it is known as fiat money. If the government demands taxes in a certain currency as 'legal tender' then that is a currency that will be required by traders. In a system that sidelined the influence of the goldsmiths, King Henry I demanded taxes to be paid using tally sticks.

In order to finance wars rulers require money, and at one time monarchs had to solicit that money from the wealthy or extort it from the people in the form of taxes. Today fiat currency allows governments to increase their spending without directly taxing people. Unfortunately this increase in the money supply decreases the value of money in circulation. The increase in money reduces the value of people's savings and labour, making the production of fiat money in essence a hidden tax. It requires people to work for that which is created from nothing. Working for nothing is slavery.

Nor would lockdown or vaccines. The money for all these schemes had to be created from nothing and logged as a debt which is saddled on the people.

In the New World, the United States became the land of those free from such banking bondage. Generations fought to maintain independence from the central banks and their fiat banking system.

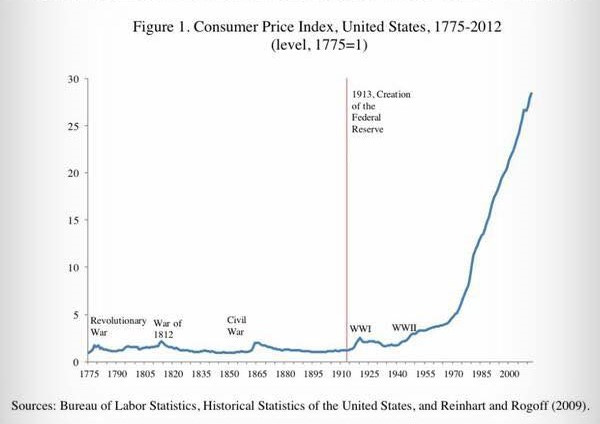

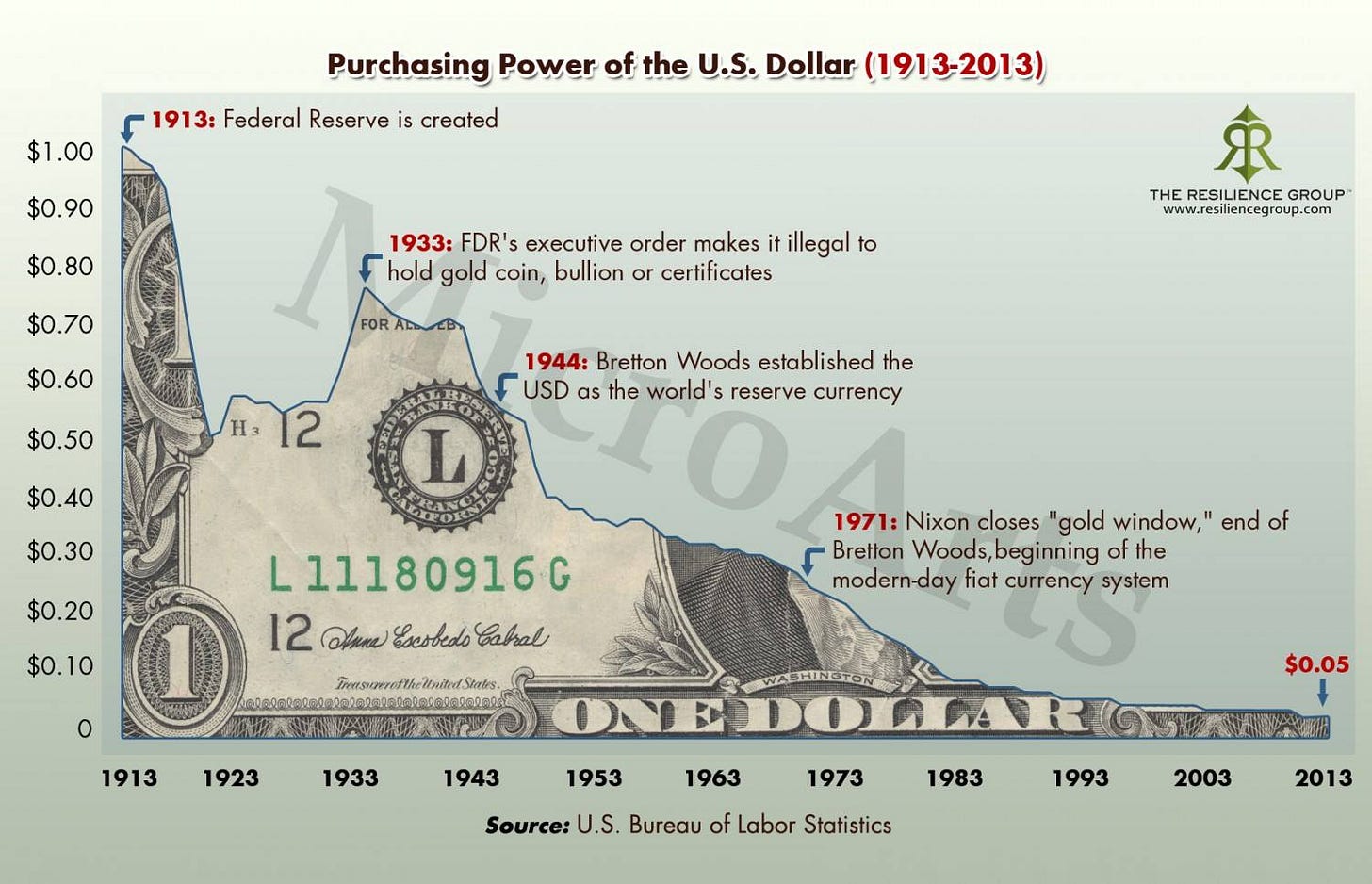

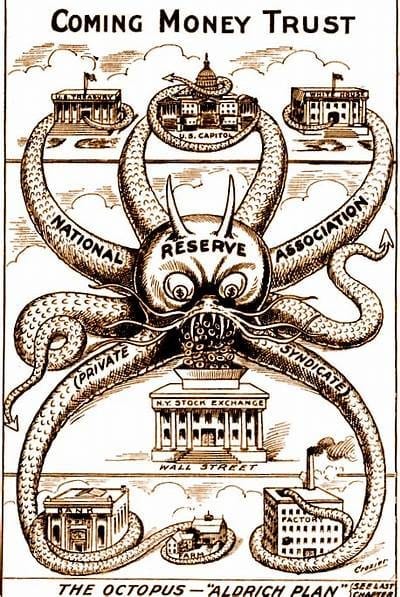

After repeated attempts to install a central bank American resistance was broken in 1913, with the duplicitous establishment of the private institution misleadingly named the Federal Reserve. By corrupting the democratic process, influencing politicians, and deceiving voters, the Federal Reserve Act of 1913 was passed.

Rather than producing its own currency backed by its wealth, the land and the productivity of its people, since then the US government has borrowed its money from the private bankers of the Federal Reserve, money that the bankers generate out of nothing and the government then has to repay at interest. As the interest does not exist in the system, more money is continuously required. This relentless increase in the production of money means that it is always losing value and creating more debt.

The whole system operates on this model. Contrary to public perception, people do not borrow money from banks for mortgages, for example. The money is created on request. Prior to the request it does not exist. This means that the bank often acquires more money in interest from the purchase of a house than was required to purchase the house. Gallingly, it does so by producing money from nothing. It also means that in order to repay the interest the borrower has to find money that is already in circulation. The borrower does this by selling his labour. He works therefore in exchange for money created from nothing, and gives to the bank the value of his labour. If repayments are not made, the bank claims the house. In this way banks accumulate real wealth.

G. Edward Griffin explains of a bank loan for the construction of a house,

"The time-value of that money over thirty years ....could be justified on the basis that a lender deserves to be compensated for surrendering the use of his capital for half a lifetime. But that assumes the lender actually had something to surrender, that he had earned the capital, saved it, and then lent it for construction of someone else’s house. What are we to think, however, about a lender who did nothing to earn the money, had not saved it, and, in fact, simply created it out of thin air? What is the time-value of nothing?"

Other than creating and thus borrowing more money, the only way repayments can be made in this system (at an individual or national level) is by labour. People work to acquire notes that are produced from nothing. If that is not bad enough these notes continuously devalue, necessitating ever more labour. It is a form of slavery.

Effectively the banks have a monopoly on counterfeiting money.

Mayer Amschel Rothschild is quoted as saying, "Let me issue and control a nation's money and I care not who writes the laws."

Whether or not he actually said this, the quote contains an essential truth. Control of the money supply allows the banks to accumulate unimaginable wealth with which they can monopolise politicians, media, and industry. In addition to the servitude into which the fiat currency scam places the people, it gives central banks control over nations. The bankers are able to expand or contract the money supply, thus respectively causing inflation or recessions. In this way, the banks hold sway over governments as they can bring countries to their knees -as they did by engineering the depression of the 1930s, which led to banks claiming assets and thus taking the wealth of their victims.

The international dominance of the Federal Reserve was assured by an arrangement with Saudi Arabia in 1974, in which the US dollar became the enforced tender for the purchase of oil. Those such as Saddam Hussein and Colonel Gadaffi who sought to circumvent this arrangement paid for their insubordination with their lives.

Inflation caused by the ever increasing production of money reached an inevitable crisis point in 2008 and then again in 2019, when many times the money created to avoid a financial collapse in 2008 was produced. The coronavirus scam was used to cover this situation, and its impact is being manipulated to usher in a new digital financial system.

The rising inflation that is engineered into the system has become highly visible due to its rapid acceleration over the past few years. Described in the media as a 'cost of living crisis,' this increased financial burden has a practical effect on society and relationships. Where once a single wage could support a family, now two wages are often not enough. This puts a strain on families, that perhaps contributes to marital pressure and rising divorce rates. The continuous expense of life means people work longer hours for less wealth, resulting in them having less time, money and energy for the leisure and social pursuits that strengthen families and build communities.

If the ingredients of love can be said to include time and attention, the system has been engineered to remove love from society and to give it only to mammon. Where money is scarce, outlay is reduced to the bare essentials. Expenditure is cut on the pleasures of life or what what the social engineers of the lockdown era would have people believe are the 'non-essentials,' such as the arts. Is the functional dreariness of totalitarianism already becoming visible in the architecture of our cities and the behaviour of their inhabitants? Is there already an effective economic and social lockdown for those without the disposable income for travel and entertainment? Are people being made accustomed to rations and 15 minute cities through their finances? Certainly the skyrocketing expense increases financial restrictions.

As advances are made in technology, reason would suggest that prices would decrease; manufacturing would become more efficient, and products would require less labour and costs to produce. Instead, prices continue to rise due to the fiat money scam that steals our prosperity and the time of our lives. All other taxes pale in comparison with the hidden systemic tax of inflation. Those other taxes serve to continue the illusion that the government obtains money from the people rather than having bankers create it out of debt. They are also a further assault on prosperity.

There is a suggestion of the occult beneath these social manoeuvrings. When, in 1910, the bankers met in secret on Jekyll Island off the coast of Georgia, to formulate the establishment of the Federal Reserve, they met on the grounds of an earlier settlement. The bankers' rustic holiday complex was built directly over the buildings of the original habitation that has been thought to have been a native american site, but acccording to Tim Bensce, its weaponry and ceremonies are suggestive of Middle Eastern origin. French colonisers who encountered the culture were disgusted with their practices, and depicted them in a painting as indulging in child sacrifice over an altar. It was in a room built directly over this altar that the bankers met and conceived of their plan for the Federal Reserve.

What a fantastically written piece Francis! As someone who was in the world of financial services for 2 decades (I got out in 2018!), it breaks things down perfectly.

Fantastic article! Great education for the already informed and especially the uninformed who are willing to learn.